You Can Assume That We Have a 50 Cost Per Purchase Goal Again Not Real Number

Customer acquisition price (CAC) is a metric that has been growing with the emergence of Internet companies and web-based advertising campaigns that can be tracked.

Traditionally, a company had to appoint in shotgun fashion advertising and find methods to track consumers through the decision-making process.

Today, many web-based companies tin engage in highly targeted campaigns and track consumers every bit they progress from interested leads to long-lasting loyal customers. In this environs, the CAC metric is used by both companies and investors.

CAC, as you probably know, is the cost of convincing a potential client to purchase a product or service. In this article, we will explain the CAC metric in more detail, how y'all can measure it, and what steps you tin take to improve it.

What Goes Into Customer Acquisition Costs?

- Advertising costs

- Cost of your marketing team

- Cost of your sales team

- Creative costs

- Technical costs

- Publishing costs

- Production costs

- Inventory upkeep

What the CAC Metric Means to You

As mentioned above, the CAC metric is important to two parties: companies and investors. The first political party includes outside, early on-stage investors who utilize it to analyze the scalability of new Cyberspace technology companies. They can determine a company's profitability by looking at the difference between how much coin can be extracted from customers and the costs of extracting it.

For example, in terms of the upstream oil market, if an oil supply is in an area requiring heavy infrastructure investments, the amount practical to excerpt the oil may be greater than its market price per barrel.

Investors view Internet-based companies through the aforementioned lens. They are concerned with the current relationship, not on future promises of improving the metric unless they can be justified.

The other political party interested in the metric is an internal operations or marketing specialist. They use it to optimize the return on their advertising investments. In other words, if the costs to extract money from customers tin can be reduced, the visitor's profit margin improves and it makes a larger profit.

Investors are more interested in providing the company with the resources it needs, partners are more than committed to growth, and the company can use the improved profit margins to laissez passer the value to its customers for a greater market position.

How You Can Measure CAC

Basically, the CAC tin can be calculated by simply dividing all the costs spent on acquiring more customers (marketing expenses) by the number of customers acquired in the period the coin was spent.

For example, if a company spent $100 on marketing in a year and acquired 100 customers in the same yr, their CAC is $one.00.

There are caveats about using this metric that you should be aware of when applying it.

For instance, a company may accept made investments on marketing in a new region or early stage SEO that it does not expect to see results from until a later period. While these instances are rare, they may cloud the relationship when calculating the CAC.

It is suggested that you perform multiple variations to account for these situations. However, we will provide some examples of calculating the CAC metric in its most businesslike and simple class with two examples. The outset company (Instance one) has a poor metric. The second (Instance ii) has a great ane.

Example 1: An E-Commerce Company

In this case, nosotros take a fictitious e-commerce company that sells organic food products. The visitor spent $100,000 on advertising last month, and its marketing squad says x,000 new orders were placed. This suggests a CAC of $10, a effigy that has no pregnant in itself.

If a Mercedes-Benz dealer has a CAC of $x, the management team will exist delighted when looking at the yr'due south financial statements.

However, in the case of this company, the average order placed by customers is $25.00, and it has a markup of 100% on all products. This means that on average, the company makes $12.50 per sale and generates $two.50 from each customer to pay for salaries, web hosting, office space, and other general expenses.

While this is the quick and dirty calculation, what happens if customers make more than one purchase over their lifetime? What if they completely stop shopping at brick and mortar grocery stores and buy from only this visitor?

The purpose of customer lifetime value (CLV) is specifically designed to resolve this. Yous tin find a CLV calculator by simply searching in your favorite search engine. In general, this metric helps you form a more accurate understanding of what the customer acquisition cost means to your company.

A $10.00 customer conquering cost may be quite low if customers make a $25.00 purchase every week for 20 years! However, in this ecommerce company, they are struggling to continue customers and most of the customers brand merely one purchase.

Example 2: An Online CRM (SaaS) Software Company

The company in this example provides an online system for managing sales contacts for customer relationship management. The cost of distributing the software is low since information technology is cloud-based, and customers need little support.

It is also able to easily retain customers because of the hurting customers would experience uploading all the contacts, tasks, and events they are tracking onto a new CRM software.

The visitor has worked its manner upward the search engines and has an expert sales support team working for minimum wage, based out of their call centers in a rural Midwestern boondocks.

The company also has many strategic partnerships that provide a steady supply of customers. In fact, they spend only $two.00 acquiring a new customer with a lifetime value of $2,000. Here is the calculation:

- Total cost of new customer sales support telephone call centers: $1,000,000/year

- Total toll paid to strategic alliance partners per customer: $ane.00

- Total monthly spending on search engine optimization: $20,000/year

Full new customers generated in the yr: 1,020,000

Customer acquisition cost: ($1,020,000 / 1,020,000 customers) + $1.00 per customer = $2.00

As in our previous example, the corporeality is worth only the money extracted from customers. This company has used a customer retention calculation to determine its customer lifetime value (CLV) is $two,000.

This means this particular company is able to turn a $2.00 investment into $ii,000 of revenue, which is bonny to investors and a betoken to the marketing team that an effective system is in place.

What About CAC Per Marketing Aqueduct?

Knowing the CAC for each of your marketing channels is what almost marketers want to know.

If yous know which channels have the everyman CAC, you know where to double downward on your marketing spend. The more you lot can allocate your marketing upkeep into lower CAC channels, the more customers y'all can obtain for a fixed budget amount.

The simple approach is to intermission out your spreadsheet and gather all your marketing receipts for the twelvemonth, quarter or month (however y'all want to do it) – and add upwards those amounts past channel.

For example, how much did you spend on Google Adwords and Facebook advertising? In this case, you might put this in a cavalcade called "PPC" or "Pay-Per-Click". How much did you spend on SEO and blogging? This might go into a column called "Inbound Marketing Costs".

At present that y'all know how much you spent on each channel, you can apply a simplistic formula and presume each aqueduct "worked" to become the same amount of customers as the next channel. This would be an averaging method.

The only issue is that it can be difficult to know what channel is responsible for which customers. You lot can easily see where this approach becomes futile.

Say you lot just ran one Pay-Per-Click advertisement on one day – just as a exam. You spent $10 full and that's all. When you look at your spreadsheet, it volition appear Pay-Per-Click would exist the all-time marketing channel considering of its extremely depression CAC. It would exist unwise to double down on Pay-Per-Click because you lot know you really didn't utilize it all for that catamenia of time.

For e-commerce companies that sell concrete products, information technology'south piece of cake to know what Pay-Per-Click advertisements atomic number 82 to direct sales because of the conversion tracking the advertising platform provides.

In this instance, you tin determine that value and note this in your spreadsheet. This will give you a improve thought of how your Pay-Per-Click campaigns are doing relative to the balance of your marketing spend.

Also, with tools like customer analytics, you can trace paying customers back to their "last bear upon" attribution source. This means y'all can see the concluding aqueduct the customer visited before doing their first sales with your online business.

For example, if a customer came from an organic search result, you would know that SEO would be responsible for that client acquisition.

At present, this is where marketing gets philosophical.

I schoolhouse of idea is that each marketing channel supports the side by side aqueduct – information technology's a combined endeavour. Your blog posts reinforce your Pay-Per-Click ads, and all channels piece of work together to bring in customers.

This is a common notion in outdoor advertising. Billboards reinforce T.V. campaigns, which reinforce radio spots, and so on. Ultimately it comes downward to your ain company's philosophy on how to attribute customer acquisition.

If you lot feel that final touch on is "good enough," y'all can use that model for your CAC calculations.

Nevertheless, y'all may have wildly popular viral videos (retrieve Dollar Shave Club) or a blog that drives a lot of word-of-mouth referrals. These plain support your overall marketing efforts and tend to exist more difficult to track and aspect to client acquisition.

How Yous Can Improve CAC

We all wish customer acquisition price margins are like Instance 2. The reality is that our advertisement campaigns can always be more effective, customer loyalty can always be improved, and more value can always be extracted from consumers. There are several methods your business organisation can utilise to improve its customer conquering costs in its industry:

- Improve on-site conversion metrics: 1 may gear up up goals on Google Analytics and perform A/B split testing with new checkout systems in order to reduce shopping cart abandonment rate and meliorate the landing page, site speed, mobile optimization, and other factors to enhance overall site operation.

- Enhance user value: By the highly conceptual notion of "user value," we mean the ability to generate something pleasing to the users. This may be additional feature enhancements/qualities that consumers have expressed involvement in. It may be implementing something to improve the existing product for greater positioning, or developing new ways to make money from existing customers. For instance, y'all may realize that client satisfaction ratings take a positive correlation with retention rate.

- Implement client relationship management (CRM): About all successful companies that have repeat buyers implement some form of CRM. This may be a circuitous sales team using a deject-based sales tracking organization, automated email lists, blogs, loyalty programs, and/or other techniques that capture client loyalty.

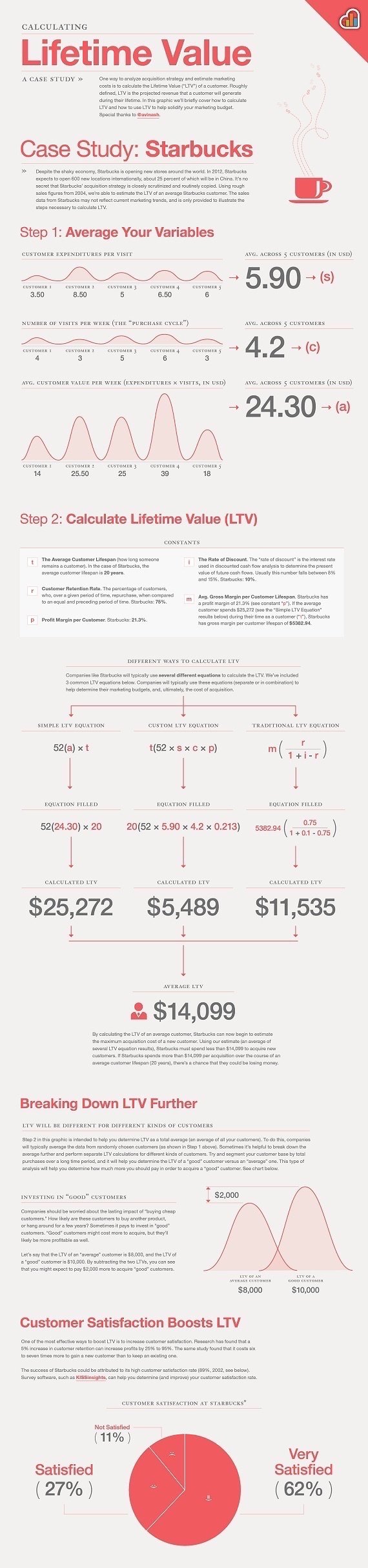

Customer Lifetime Value

In addition to knowing your customer acquisition costs, you should also be interested in knowing your customer lifetime value. This infographic will assist you.

Desire to acquire more nigh LTV? Bank check out this video:

Customer Acquisition Cost FAQs

What is customer acquisition cost?

CAC is the toll of convincing a potential customer to buy a production or service.

What costs are function of full customer acquisition price?

Advertising, employee and contractor salaries, tools, inventory maintenance, and other sales and marketing tactics are all parts of CAC.

How practice I calculate customer acquisition cost?

Take your total expenses spent on acquiring customers over a specific time flow and divide it by the number of customers y'all gained in that same time menstruation.

How practise I improve customer acquisition cost?

Things to amend include: on-site conversions, user value, and better customer relationship direction processes and tools.

Customer Acquisition Cost Conclusion

Measuring and tracking customer acquisition costs is important for both investors and your company.

Investors can utilize CAC to assistance them determine whether or not they recollect your visitor is, and will continue to be, profitable.

Businesses tin can use it to classify resources and funds, strategize marketing campaigns, and guide them in their hiring and salary process.

For aid identifying factors that should exist included in your CAC calculation, or for other digital marketing guidance, we are hither to help.

Nearly the Author: Chase Hughes has six years of experience working in the consulting sector and iii years in the private equity sector for big multi-nationals and emerging startups. He is the founding partner of a service that writes business plans for debt and equity capital for startups.

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

- SEO - unlock massive amounts of SEO traffic. See real results.

- Content Marketing - our squad creates epic content that will get shared, get links, and attract traffic.

- Paid Media - effective paid strategies with articulate ROI.

Volume a Call

Source: https://neilpatel.com/blog/customer-acquisition-cost/

0 Response to "You Can Assume That We Have a 50 Cost Per Purchase Goal Again Not Real Number"

Postar um comentário